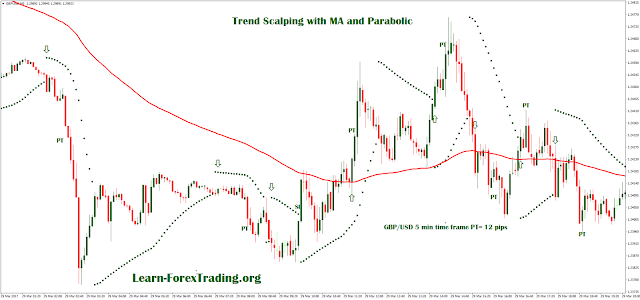

Trend- scalping strategy based

on SMA smoothed and Parabolic SAR.

Time frame 5 min, 15 min and 30 min.

Currency pairs: majors.

Trading Session: London and New York.

Indicators setting

60 moving average smoothed, low.

Parabolic SAR (0.11 – 0.011)

Fractals

The MA 60 is for to identify the

direction of the price.

Go to long when the price is above the

SMA 60. Go short when the price is below of MA 60.

The Parabolic SAR is for the timing for

entry buy/sell.

Buy

1. price to go above the MA 60.

2. Parabolic SAR indicator dot below

the price.

3. This is the signal to enter for a

buy order.

4. The stop loss is set at 12-18 pips

below the entry price.

5. Profit target 7-18 pips.

Sell

1. price to go below the MA 60.

2. Parabolic SAR indicator dot above

the price.

3. This is the signal to enter for a

sell order.

4. The stop loss is set at 12-18 pips

above the entry price

This strategy can generates false

singnals in range market

Optional

For avoid less false signals at this

strategy I add fractals with this indicators the new rules are the

following:

Buy

When the previous buy conditions are

met for entry wait that the price breaks last high fractal.

Sell

When the previous sell conditions are

met for entry wait that the price breaks last low fractal.

Another filter is the multi time frame

analysis, trade only in the direction of the trend of time frame

higher. Example 5 min -30 min, 15 min- 60 min, 30 min-240 min.

In conclusion, applying these two

filters: breaks high / low fractals and Multi Time Frame analysis the

signals are more accurate.

Post a Comment