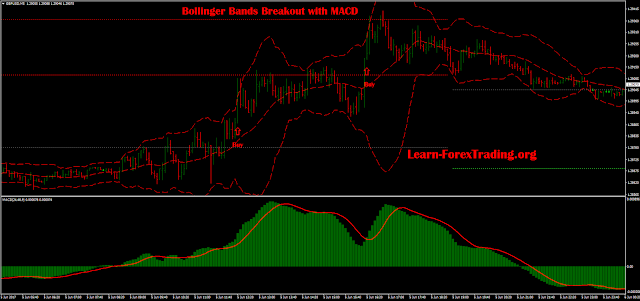

Bollinger

Bands Breakout with MACD is a trend following breakout day

trading strategy

Slow

MACD oscillator is used to identify the direction of market (uptrend

or downtrend) The Bollinger bands indicator are used to catch only

strong trends.

Time

Frame 5 min.

Currency

pairs: GBP/JPY, GBP/USD, USD/JPY, USD/CHF, EUR/USD.

Forex

Indicators:

Slow

MACD (24, 48,9);

Bollinger

Bands (period 20 , deviation 3.0).

Pivot

Points Level

Trading

rules

Buy

MACD

Line Crosses upward signal line.

MACD

Histogram is above zero level.

The

price close above the upper bands of Bollinger Bands.

Sell

MACD

Line Crosses downward signal line.

MACD

Histogram is below zero level.

The

price close below the lower bands of Bollinger Bands.

Exit

Initial

stop loss 4 pips below/above the middle band.

Profit

target 10-15 pips depends by currency pairs or at the level of the

pivot points.

In the pictures Bollinger Bands Breakout with MACD.

Post a Comment