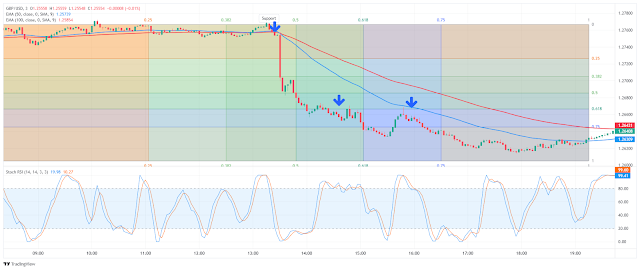

The scalping strategy applied to GPBUSD, EURUSD, AUDUSD, and NZDUSD revolves around a straightforward approach based on trend momentum, utilizing moving averages and StochasticRSI. This trading system is specifically tailored for short timeframes.

Setup

Strategy:

Crucial

to the strategy's success are the designated trading hours:

London:

9:00-11:00 GMT (Berlin)

GMT (Berlin): 15:00-20:00 GMT

(Berlin)

Tokyo (for AUDUSD and NZDUSD only): 2:00-7:00 GMT

(Berlin)

Timeframes:

1 minute, 2 minutes, 3

minutes

Pairs:

EUR/USD, GBP/USD, AUD/USD

Spreads:

Maximum

0.0015

Platforms:

TradingView

Indicators:

100

EMA (Exponential Moving Average)

50 EMA

StochasticRSI

(14,3,3)

Gann

Box tool

Trading Rules:

At

9:00, insert the Gann Tool and trace it horizontally for the entire

London and New York session, vertically to the top base of the

oscillator in the sub-window, and the top window of the

chart.

Horizontal lines denote support, resistance, and profit

target levels.

Buy

50

EMA > 100 EMA.

Identify significant resistance levels on the

Gann Box.

Wait for the stochastic oscillator to trade back above

20.

Initiate long trades.

Set stop loss 3 pips below

support or at the previous swing low.

The profit target should

be at least 5-12 pips.

Sell

50

EMA < 100 EMA.

Recognize significant support levels on the

Gann Box.

Wait for the stochastic oscillator to trade back below

80.

Open to short trade.

Set stop loss 3 pips above the

resistance or at the previous swing high.

The profit target

should be at least 5-12 pips.

Post a Comment