The Double Supertrend with ATR TradingView Strategy utilizes a proprietary indicator derived from two Supertrend indicators, which are adjusted with specific parameters to minimize market noise and false signals. This strategy is optimized for time frames of 15 minutes or higher and can be applied to various financial instruments including currency pairs, cryptocurrencies, gold, indices, and oil. By fine-tuning the indicator's parameters, traders can enhance signal quality and apply effective filters to refine their trading decisions.

Setup Strategy

Time Frame 15 min or higher

Currency pairs: cryptocurrencies, gold, indices, and oil.

Indicator: Double SuperTrend by Thiago Schmitz download below the article

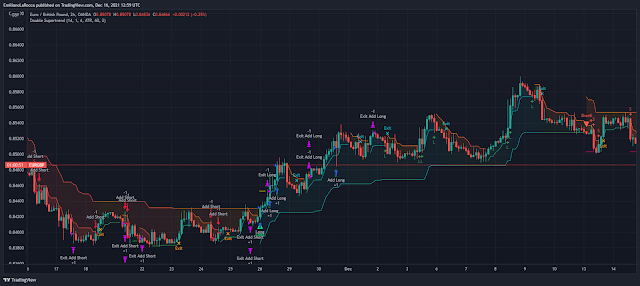

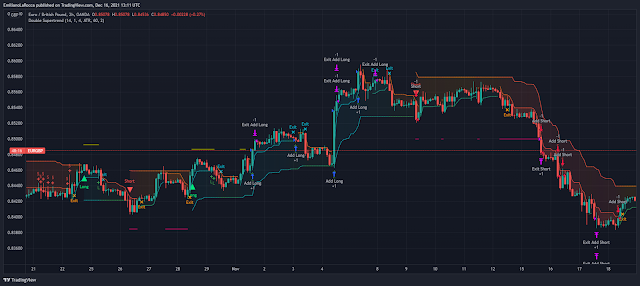

EXAMPLE

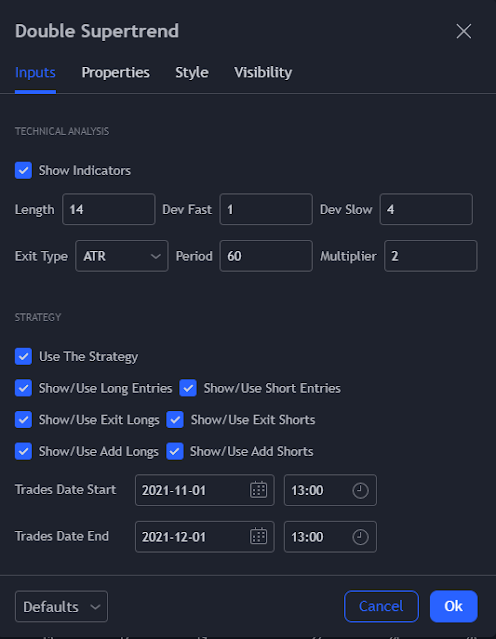

CONFIGURATIONS

Here

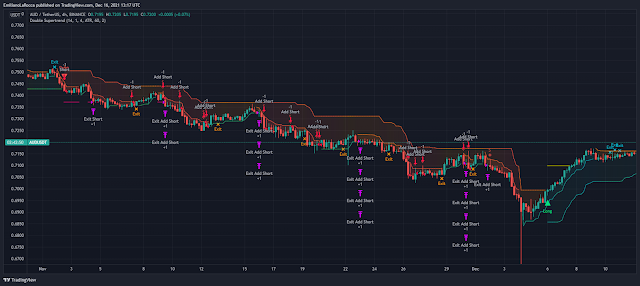

are some configuration ideas for some markets (all of them are from

crypto, especially futuresmarkets)

BTCUSDT15min

- Default configuration

BTCUSDT1h

- Length 10 | Dev Fast 3 | Dev Slow 4 | Exit Type ATR | Period 50 |

Multiplier 1

BTCUSDT4h

- Length 10 | Dev Fast 2 | Dev Slow 4 | Exit Type ATR | Period 50 |

Multiplier 1

ETHUSDT15min

- Length 20 | Dev Fast 1 | Dev Slow 3 | Exit Type Fast Supertrend |

Period 50 | Multiplier 1

EUR/GBP H2 default setting.

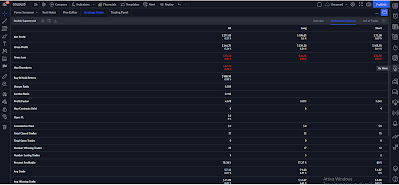

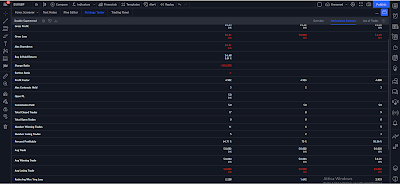

In the following images I will show you the example report.

Setting Supertrend options

☑ Show Indicators

This

option will enable/disable the Supertrend indicators on the chart.

☑

Length

The length will be used on the Supertrend Indicator to

calculate its values.

☑ Dev Fast

The fast deviation or

factor from one of the super trend indicators.

☑

Dev Slow

The slow deviation or factor from one of the super

trend indicators.

☑ Exit Type

It's

possible to select from 4 options for the exit signals. Exit signals

always take profit targets.

☑ ⥹ Reversals

This

option will make the strategy/indicator calculate the exit signals

based on the difference between the given period's highest and lowest

candle value (see Period on this list).

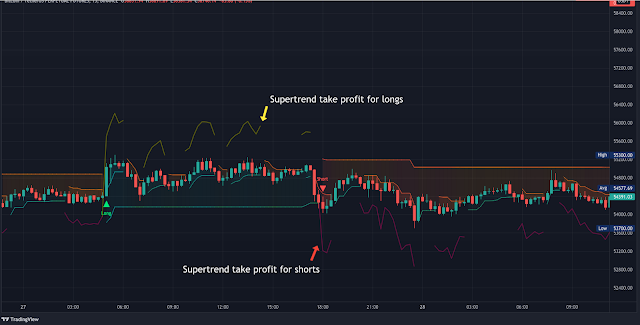

☑ ⥹ ATR

Using ATR as a base indicator for exit signals will make the strategy/indicator place limit/stop orders. Candle High + ATR for longs, Candle Low - ATR for shorts. The strategy will show the ATR level to take profit and stick with it until the next signal. This way, the take profit value remains based on the candle of the entry signal.

☑ ⥹ Fast Supertrend

With this option selected, the exit signals will be based on the Fast Supertsignal value, mirrored to make a profit.

☑ ⥹ Slow

Supertrend

With

this option selected, the exit signals will be based on the Slow

Supersignal

value, which is mirrored to take profit.

HOW

TO USE

It's

very straightforward. A long signal will appear as a green arrow with

a text Long below it. A short signal will appear as a red arrow with

a text Short above it. It's ideal to wait for the candle to finish to

validate the signal.

The

exit signals are optional but give a good idea of the configuration

used when backtesting. Each market and timeframe will have its own

configuration for the best results. On average, sticking to ATR as an

exit signal will have less risk than the other options.

☑

Entry

Signals

Follow

the arrows with Long/Short texts on them. Wait for the signal candle

to close to validate the entry.

☑

Exit

Signals

Use

them to close your position or to trail stop your orders and maximize

profits. Select the exit type suitable for each timeframe and

market

☑

Add

Entries

It's

possible to increase the position following the add margin/contracts

based on the Add signals. Not mandatory, but may work as reentries or

late entries using the same signal.

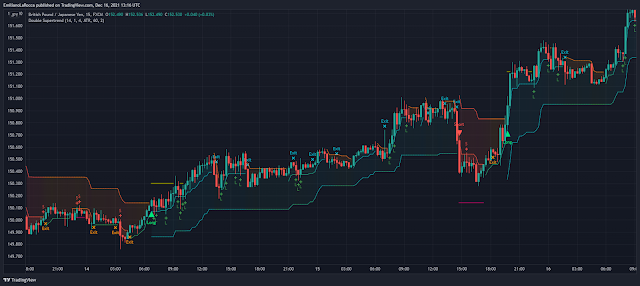

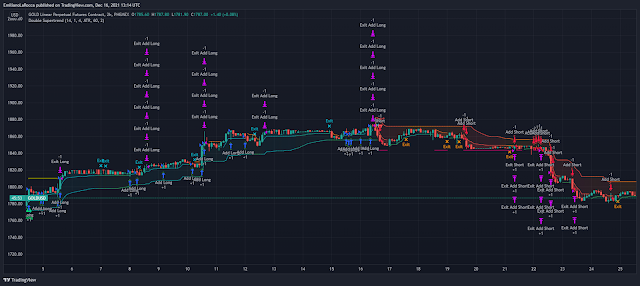

Examples of trades

Download

https://drive.google.com/file/d/1HRPjsMbMaz18mYnKN0xzQNNWHpuSUSq0/view?

Post a Comment